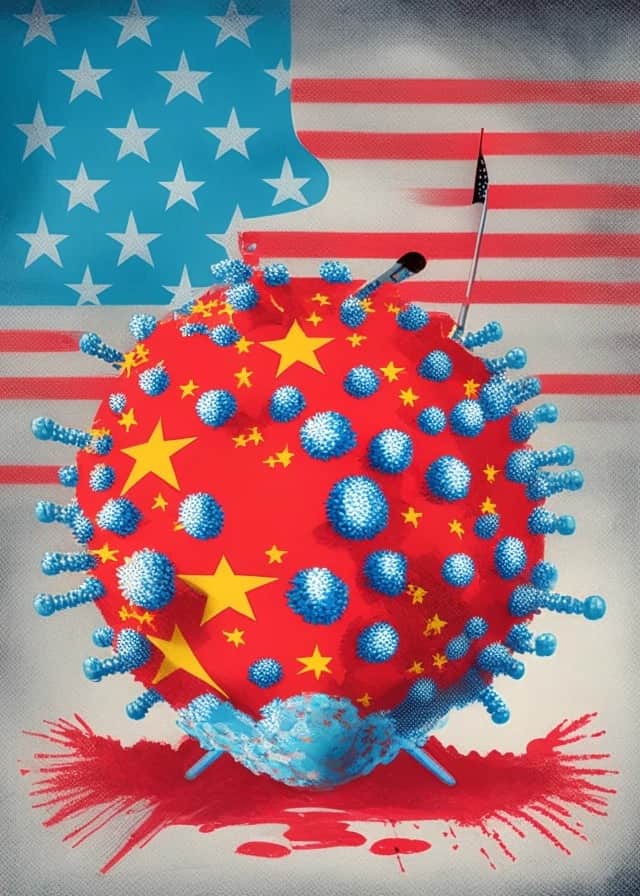

Les États-Unis et la Chine ont tous deux été touchés par la pandémie de COVID-19. Cependant, les deux pays ont adopté des approches différentes pour lutter contre la propagation du virus.

L’attitude vis-à-vis de la pandémie : laxisme vs zéro covid

Aux États-Unis, le président Trump a minimisé la gravité de la pandémie et a tardé à prendre des mesures pour la combattre. Il a également critiqué les experts en santé publique et les gouverneurs qui ont pris des mesures pour limiter la propagation du virus. En conséquence, les États-Unis ont connu l’un des taux de mortalité les plus élevés au monde en raison de la pandémie.

En Chine, le gouvernement a pris des mesures strictes pour limiter la propagation du virus dès le début de l’épidémie : politique zéro Covid. Les autorités ont rapidement mis en place des mesures de confinement et de quarantaine pour les personnes infectées et celles qui ont été en contact avec elles. Les autorités ont également mis en place un système de traçage des contacts pour identifier rapidement les personnes qui ont été exposées au virus => utilisation massive de la technologie (contact tracing, logiciels de géolocalisation, QR codes, reconnaissance faciale).

En résumé, les États-Unis et la Chine ont adopté deux approches très différentes pour lutter contre la pandémie de COVID-19 :

- Les États-Unis ont tardé à prendre des mesures pour combattre le virus,

- tandis que la Chine a rapidement mis en place des mesures strictes pour limiter sa propagation.

Le nombre de morts : un facteur 10

Aux États-Unis, il y a eu 1,13 million de décès liés au coronavirus recensés dans le pays depuis le début de l’épidémie. En Chine, il y a eu 121 000 décès. Pour rappel, en France, nous avons eu 163 000 décès.

Taux de vaccination : peu de différence

En ce qui concerne la vaccination, la Chine a vacciné entièrement plus de 70 % de sa population. Aux États-Unis, environ 60 % de la population est entièrement vaccinée contre le COVID-19.

Il est à noter que les vaccins occidentaux et chinois n’ont pas eu les mêmes niveaux de diffusion. Autant les vaccins occidentaux ont eu une diffusion massive, autant les vaccins chinois ont surtout été utilisés en Chine.